Time-locked Wallets: An Introduction to Smart Contracts

Over the past few years, interest in blockchain has been growing at a tremendous rate, since the technology allows us to solve a lot of problems. It is advisable to create a separate blockchain-based application for the needs of each company. Today, its development is not complete without smart contracts Ethereum. The use of this technology has several advantages: perfect protection against fraud, improved trust between partners, and much more. In this article we will try to consider when the technology is used, what benefits and disadvantages it has.

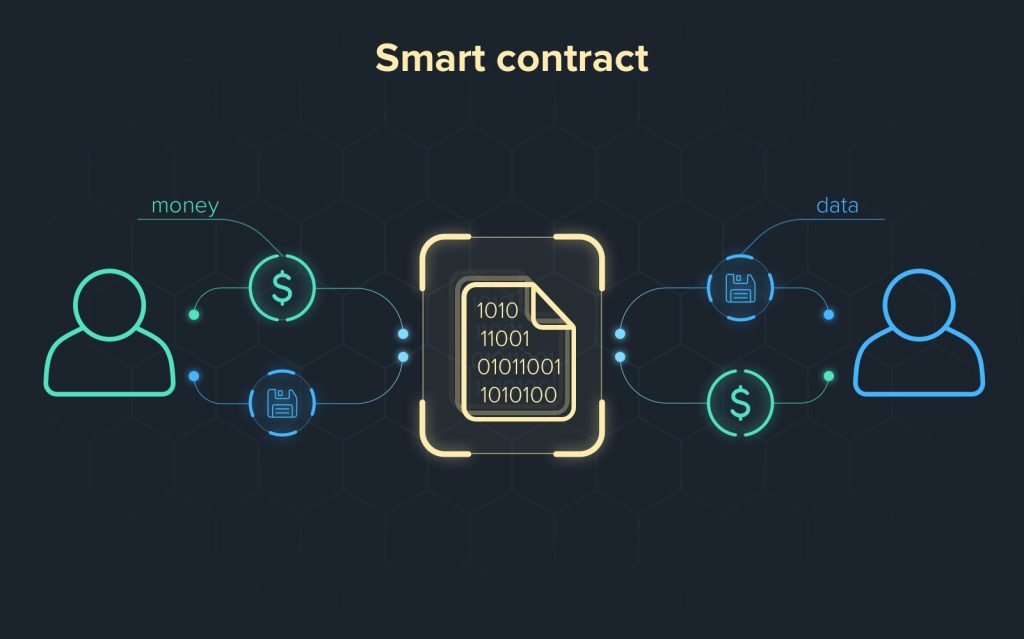

How do smart contracts work?

Crypto smart contracts have appeared quite recently (in 2013, the creator is Vitaly Buterin) but they are already very popular among all platforms that use the blockchain. The advantage of this technology is that it checks whether all the terms of the contract are being met or not. If everything is ok, it conducts the transaction, and if any of the clauses of the agreement is not fulfilled, then it blocks the financial transfer.

As a result, smart contracts not only avoid fraud but also minimize the likelihood of human error. Also, technology can save you from ill-considered spending. For example, you can set a condition under which money will be debited up to a certain amount on the balance sheet.

Ethereum wallet contract can be only as a code. Additionally, the programmer enters the most important terms of the contract. In the future, the operator must enter data on transactions or deliveries of goods so that the system understands what changes are taking place in the company.

Many experts who are just getting acquainted with this technology believe that it is too complex to understand and requires a large amount of knowledge and skills. In some aspects, this is true, however, if you can master them, then technology will solve a large number of issues.

When do I need to block funds?

The locked wallet is widely used today not only in corporations but also by individuals. The essence of this technology is that the withdrawal of money can only take place under certain conditions.

- Death of the owner. If you want to leave your savings to your family, in case something happens to you, then you can create a wallet using cryptocurrency, give it a password, but set the system to unblock the account after the death of the owner. So, they will not receive money before the due date, and taking into account the growth of cryptocurrencies, this contribution can be calculated as the best deposit.

- Reaching the age of majority. Many parents want to provide their children with all the best, so they create deposits. If you put a large amount into your account at birth, then a large amount will accumulate by the time kids come of age. An electronic wallet is better than the conditions offered by the bank because it does not take commissions and allows you to make investments in cryptocurrency.

- Pension or trust fund. Unfortunately, not all countries have a well-established pension system. If you want to secure your future, then the ideal solution is to create a wallet, replenish it regularly, but not be able to receive money until a certain age.

If a company owns a large number of assets that have been distributed among a large number of employees, then it is beneficial to create token locks. If a large number of employees decide to sell them at the same time, this will negatively affect the financial condition of the company. Smart contracts allow you to prevent negative consequences and develop clear rules according to which a shareholder can sell his assets.

Another business benefit is that smart contracts can freeze accounts when there is a danger of a hacker attack. As soon as the system senses an intrusion, it can instantly block the account, then no one can withdraw money. In the future, an authorized person will be able to enter the key, and the system will release the lock.

Technology advantages

Despite the fact that it seems quite difficult to get into the system and implement it in the work of a company or a browser. Creation such an application has several advantages:

- allows you to make sure that the migration of money through accounts is carried out according to a certain rule;

- define if it is worth making a payment, whether all the terms of the transaction have been complied with;

- helps to control the process of transferring money without your participation;

- eliminates the likelihood of fraud on the part of hackers and company employees;

- creates good conditions for cooperation with partners.

Regardless of the industry in which the company operates, smart contracts will be a good solution to streamline the decision-making process related to financial transactions.

Development of smart contracts based on Truffle

Smart contract tutorial cannot be imagined without an overview of the popular Truffle framework. Of course, you can develop a smart contract application without it (before the start you need to have Node.js and Git installed on your computer), nevertheless, it allows you to significantly speed up and do all work as easily as possible.

It is important to note that the project follows the standard Truffle structure and the directories of interest are:

- contracts: Holds all the Solidity contracts;

- migrations: Contains scripts describing how to migrate;

- test: Stores all tests of the documents.

The idea is that you can write special software that will regulate the operation of the electronic wallet. This function may not affect all financial transfers, but only to a specific account.

There are a huge number of types of Ethereum smart contract applications today. The most popular among them are cryptocurrencies and crowdfunding token sales (they can also be called initial coin offerings or ICOs).

For time lock encryption, special programming languages are used, the most popular of which is Solidity. Each project may include several contract terms. Regardless of whether the agreement between the parties was oral or written, the specialist must enter them into the application code so that the system can work correctly.

Today there are a huge number of manuals that are released by developers, they will allow you to quickly and easily understand the code, understand how and where it needs to be added.

Legal component

At the moment, there is no federal law in the United States that would regulate Cryptocurrency smart contracts. Uniform Electronic Transactions Act (UETA), which was adopted back in 1999 and operates in 47 states, says that all electronic documents should be equated with written, printed on paper.

At the moment, many experts are inclined to believe that it is worth creating conditions under which a given computer code was equated to a document. However, each state reserves the right to independently decide this issue.

For example, an insurance company that provides life and health insurance for flights may provide a service that provides a penalty payment in case the flight is delayed by more than 2 hours. The key conditions in such cases are written in the main contract on paper, and some auxiliary conditions are written only in the smart contract.

As a result, if an insured event occurs, provided only in a smart contract, then the insurance agency may refuse to fulfill it. In the future, only the court will be able to decide who is right in this situation.

What currency can be used in wallets?

Practice shows that you can connect a smart contract to a wallet with any currency, but it is often used for cryptocurrencies. This is because many people keep ordinary currency in a bank, where all transactions are checked by the institution's system.

Many people prefer to pay for goods and services using cryptocurrency without intermediaries through blockchain technology.

Smart contract coins are completely safe, as they allow you to create really good protection against fraud and rash actions.

Conclusion

Time-locked Wallets are becoming a good solution for both a large corporation and an individual. They allow you to create deposits in really good conditions, create a stable financial fund that is completely protected from outside influences.

The advantages of smart contract are that they can be installed both on active accounts that constantly conduct transactions and on those that are used exclusively as accumulative ones.